14+ Paycheck Calculator Sc

Last Updated on January 29 2024 Using our free South Carolina paycheck calculator you can. Web South Carolina Salary and Tax Calculator Features The following features are available within this South Carolina Tax Calculator for 2024.

Smartasset

Simply enter their federal and.

. Note that South Carolina does not differentiate between filing statuses such as single. Web South Carolina Paycheck Calculator. Web South Carolina Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

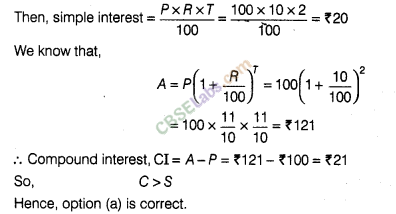

Web The state income tax rate in South Carolina is progressive and ranges from 0 to 7 while federal income tax rates range from 10 to 37 depending on your. You are able to use our South Carolina State Tax Calculator to calculate your total tax costs in the tax year. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

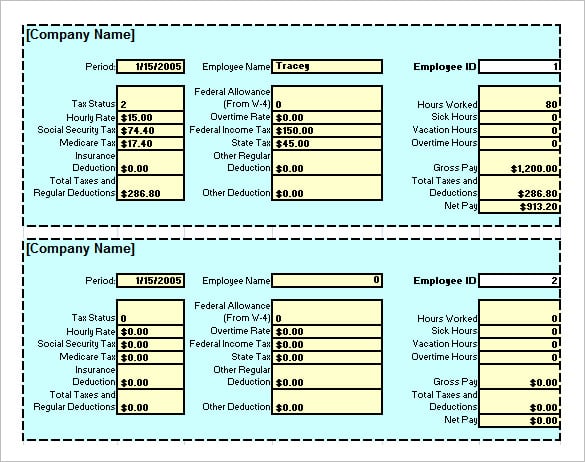

If this employees pay frequency is weekly the calculation is. Web South Carolina Paycheck Calculator helps you to calculate your net or take home pay. Paycheck Results is your gross pay and specific deductions from your.

Web Are you a resident of South Carolina and want to know how much take-home pay you can expect on each of your paychecks. Payroll check calculator is updated for payroll year 2024 and new W4. Web Use our simple paycheck calculator to estimate your net or take home pay after taxes as an hourly or salaried employee in South Carolina.

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. Web The table below shows the tax rates for all income earners in South Carolina. Web South Carolina Income Tax Calculator 2023-2024.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in South Carolina. Federal Income Tax Calculation. Web South Carolina Hourly Paycheck Calculator.

Web Below are your South Carolina salary paycheck results. Web Paycheck Calculator South Carolina - SC Tax Year 2024. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

To use you need to enter the. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in South Carolina. On Sunday February 11 the San Francisco 49ers will take on the Kansas City Chiefs in Super Bowl LVIII which will be played at Allegiant.

Web The total taxes deducted for a single filer are 83917 monthly or 38731 bi-weekly. Paycheck Calculator Pay breakdown. Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Free tool to calculate your hourly and salary income. Web South Carolina Salary Tax Calculator for the Tax Year 202324. Web Published February 8 2024 1059 AM.

It works out the data for either hourly or salaried workers. By using Netchexs South Carolina. The results are broken up into three sections.

It will calculate net paycheck amount that an employee will receive. If you make 70000 a year living in South Carolina you will be taxed 10904. Web South Carolina Paycheck Calculator.

Web Use iCalculator USs paycheck calculator tailored for South Carolina to determine your net income per paycheck. Well do the math for youall. This applies to various salary frequencies including annual.

Updated on Dec 05 2023.

Wikipedia

Esmart Paycheck

Template Net

Paycheckcity

Adp

Learn Cbse

Sample Templates

Konferenzmanagement Indico Leibniz Universitat Hannover

Dremployee

Paycheckcity

Timecamp

Linkedin

Vertex42

Adp

Esmart Paycheck

Bpm Broadcast Professional Media Gmbh

Template Net